Investment Management

Our investment management service is designed to deliver your financial goals using a robust framework that leverages our collective investment committee approach.

Investments designed with you in mind

We offer a personalised investment management service. We take into consideration your personal circumstances and objectives as well as those of your wider family. We will consider your career and business aspirations, lifestyle changes and even the legacy that you would like to leave behind. Using this full understanding of your goals, your time horizon and your circumstances, we will provide an investment solution designed to deliver on performance while balancing your risk preferences.

Enquire about becoming a client

Investment Committee Series

Our Investment Committee share their key decisions and outlook for Q2 2024 here

Quote -

“We are dedicated to making investment decisions which are supported by a clear, robust and repeatable research framework. Our clients depend on us to achieve their objectives. Our philosophy and process are designed to ensure that we do just that.”

–Eren Osman, MD of Wealth Management

Investing with us

You will be matched with a qualified and experienced investment manager who will be your main contact point and direct line into our Investment Committee.

All our Investment Managers sit on our Investment Committee through which we construct and manage our client portfolios. We have no conflicts as a result of “in-house” products, instead, we research the entire fund management universe and invest only in teams and strategies that we believe to be best in class. All investment strategies and portfolio changes are approved at committee level, leveraging our collective experience, promoting active discussion, constructive debate and delivering a robust governance structure.

Transparency is important to us. You will always have direct access to those who make investment decisions on your behalf. Outside of your review meetings, your investment manager will provide financial market and performance updates as well as advice or guidance as required.

We provide a discretionary portfolio management service, where you delegate the day-to-day investment decision making responsibilities to our Investment Committee. Many investors choose this approach as it relieves them of the responsibility and frees up time to spend on the things that matter to them most.

We offer a personalised service and will tailor the experience for you. You may wish to meet annually or prefer more regular contact with your Investment Manager. You are always welcome to bring family members or other advisors with you. Through Digital Wealth, you can monitor your portfolio and access key documents at your convenience. Whether you are new to investing or have many years of experience, our team has the experience and expertise to ensure you get the level of support.

We firmly believe that investors with similar objectives and risk tolerance should achieve consistent outcomes over time. We aim to achieve this via a centralised framework through which the Investment Committee delivers our collective view across all client portfolios. We deliver model-based portfolios across a range investment styles and risk levels, meaning that whatever your investment preferences, we will have a solution that is right for you.

We believe the key to successful long-term investing is active management and diversification. Over time, diversification mitigates short-term volatility by spreading your portfolio across different asset classes and strategies while active management allows you to benefit from short-term market opportunities.

All our model portfolios have a long-term strategic asset allocation, which is set by our Investment Committee, and reviewed annually. This is the ‘neutral’ or ‘base case’ portfolio asset allocation. For most of our investment services, we then have a shorter-term tactical asset allocation overlay whereby we adjust the asset allocation to take advantage of near-term opportunities or to react to market movements.

We may invest across all major asset classes, including:

- Fixed Interest

- Gilts

- Corporate bonds

- Emerging market debt

- Equities

- Developed markets

- Emerging markets

- Commercial property

- Alternatives

- Alternatives

- Hedge funds

- Infrastructure

We believe that outperformance is delivered by being receptive to changing market conditions and having the confidence and expertise to react accordingly. Our framework allows for the flexibility to be creative in our approach whilst our governance process ensures that we remain true to our core structures, disciplines, and beliefs.

We advocate investing for the long-term as true performance is delivered by compounding returns over time. By combining this long-term approach with strong diversification and active management we aim to deliver consistent value, in line with your appetite for risk and growth expectations.

While short-term fluctuations in financial markets, and therefore portfolio valuations, can be disconcerting, discretionary portfolio management can alleviate concerns. We recognise that when markets are volatile, you may feel more nervous. We will communicate with you on a regular basis, ensuring you have access to the thoughts and decisions of our investment committee. Your Investment Manager will be available to discuss your portfolio and any changes we make to it.

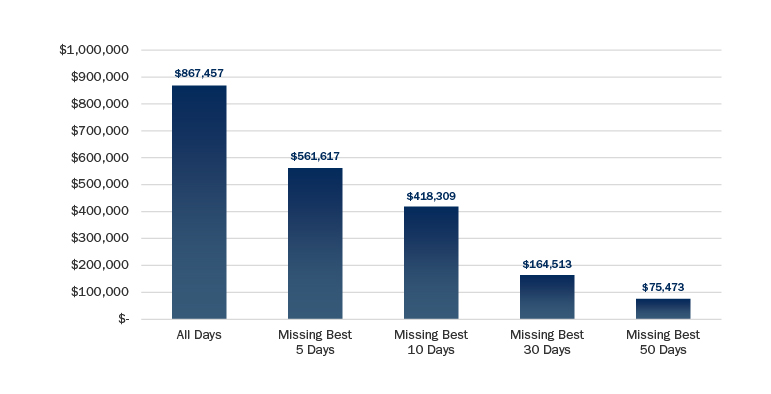

The adage of time in the market, rather than timing the market is commonly touted by financial commentators and advisers alike, and for good reason. Often, although not always, some of the best single-day investment performance returns come straight after some of the worst. This means that for investors who are trying to time the market, those who may have ‘sold out’ as markets were falling can often miss the upside when markets recover.

Below is a chart from Bloomberg Data which shows the impact on returns of missing the best five, 10, 30 or 50-single days for the S&P 500 between 1979 and 2019. The figures are based on an initial investment of $10,000 with dividends being reinvested. As you can see, even missing the best five days has a notable impact on final returns. Those investors who can ‘sit tight’ through the volatility are usually rewarded over the long-term.

Source: Bloomberg. Data is for illustrative purposes only. Returns are total returns and are not intended to imply or guarantee future performance. The illustration excludes the effects of taxes and brokerage commissions or other expenses incurred when investing. These returns were the result of certain market factors and events which may not be repeated in the future. The S&P 500 Index is an unmanaged index that measures large-cap US stock market performance. The index cannot be purchased directly by investors.

Please remember that past performance is not an indicator of future performance and that your capital is at risk. Investments can go down as well as up.

Becoming a client

Take control of your financial future today by completing our enquiry form. Alternatively, you can call us on the number below and one of our team will be delighted to talk about your future.

Plan for tomorrow

Wealth Planning

We take an in-depth look at your business and personal financial needs. We use our expertise to create and implement a flexible plan that is unique to you and designed to help you protect, grow, and pass on your wealth in a tax efficient way.

Latest insights

Read all our latest thinkingAre we the bank for you?

Interested in banking with Arbuthnot Latham? Send us an enquiry and we will be more than happy to talk about your future.

Find out more

Communication & Fees

Long-term, mutually beneficial relationships are forged through the trust and understanding built through constant communication. That starts with your dedicated Senior Investment Manager.

Brochure & email subscriptions

Request a brochure, or subscribe to our email updates

DISCLAIMER

This document should be considered a marketing communication for the purposes of the FCA rules. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is not subject to any prohibition on dealing ahead of the dissemination of investment research. It is for information purposes only and does not constitute advice, a solicitation, recommendation or an offer to buy or sell any security or other investment or banking product or service. You should seek professional advice before making any investment decision. The value of investments and the income from them can fall and rise, and you could get back less than you invest. Past performance is not a reliable indicator of future results. Investment returns may increase or decrease as a result of currency fluctuations.

This document is not directed at, or intended for distribution to or use by any person located in the United States or any other jurisdiction where such distribution or use is prohibited. It may not be distributed to or used by any US Person. The contents of this document are based on opinions or conditions as at the date of writing and may change without notice. To the extent permitted by law or regulation, no warranty of accuracy or completeness of this information is given and no liability is accepted for its use or reliance on it.

This document is confidential and may not be reproduced, further distributed, or published without prior consent from Arbuthnot Latham & Co., Limited.