Wealth Planning -

Protect your wealth from inheritance tax

Record-breaking inheritance tax receipts are rolling into HMRC. But families can reduce the chances of being hit by a hefty inheritance tax bill by taking steps now. In this article, we discuss ways to ensure your beneficiaries will receive a more significant transfer of wealth.

Inheritance tax (IHT) has been a hot topic throughout the year, with record-breaking receipts flowing into HMRC, and this trend is expected to continue. The recent Autumn Budget has further highlighted the importance of IHT planning, as changes announced are likely to result in significantly higher IHT bills for many in the future.

In this article, wealth planner Gary Jasper, explores the reasons behind rising IHT receipts and the latest changes and strategies you can adopt to safeguard your wealth. Taking proactive steps now can help ensure a more significant transfer of assets to your beneficiaries.

Rising inheritance tax receipts

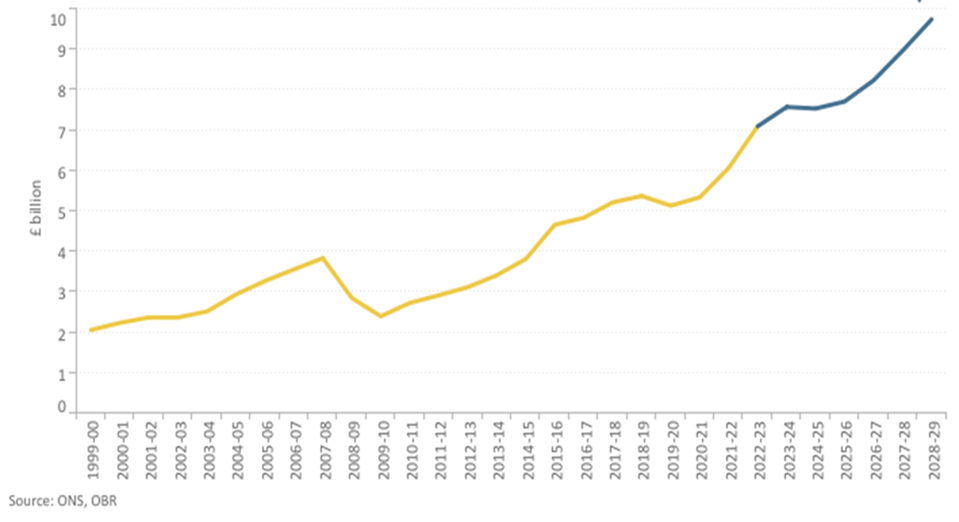

Inheritance tax receipts for April 2024 to October 2024 are £5.0 billion which is £0.5 billion higher than the same period last year. This marks a continuation of the upward trend seen in recent years.

Contributing factors include:

- Frozen IHT thresholds: These have remained unchanged since 2009 despite rising inflation.

- Rising property prices: More families are being pushed above the IHT threshold.

- Lack of financial planning: Many families are not taking advantage of available exemptions and allowances.

Graph: Inheritance tax receipts in cash terms, including HMRC’s forecast to tax year 2028/2029

Understanding IHT Allowances

Before exploring ways to protect your estate, let us revisit the two main tax-free IHT allowances:

Nil-rate band (NRB):

- Allows individuals to pass on up to £325,000 of their estate tax-free.

- Any amount above this threshold is usually taxed at 40%.

- This allowance has remained unchanged since April 2009, while inflation has reduced its value by 34.5%[1], and average house prices have increased by 86.5%[2] .

Residence nil-rate band (RNRB):

- Provides an additional allowance of up to £175,000 when passing on a main residence to a direct descendant.

- Combined with the nil-rate band, a married couple can pass on up to £1m tax-free.

- For estates valued at over £2m, the RNRB starts to reduce. Estates over £2.7m do not benefit from the RNRB at all.

The Chancellor announced that the freeze on both allowances has been extended to April 2030 (previously set to end in April 2028).

Strategies to protect your estate

1. Lifetime cashflow planning

Understanding how your assets and income support your lifestyle is essential. A wealth planner can help structure your investments to align with your goals while reducing IHT exposure.

Spend and enjoy your wealth: Reducing the value of your estate through lifetime spending is an effective way to lower your IHT bill.

2. Lifetime gifting

Gifting can significantly reduce your taxable estate. Some gifts can be made each tax year, and immediately fall outside your estate for IHT purposes, provided they qualify and are made outright. However, only a small number of estates use this exemption. According to HMRC, in the 2019-2020 tax year, only 1,900 estates claimed this exemption.

Common exemptions include:

- Annual gifting allowance: Up to £3,000 per year.

- Marriage or civil partnership gifts: £5,000 from a parent, £2,500 from a grandparent, or £1,000 from others.

- Regular gifts from income: These must not affect your standard of living.

Other considerations:

- Gifts exceeding the above allowances are tax-free if you survive seven years after making them.

- Donations to charities or political parties are always IHT free.

3. Trusts

Trusts allow you to gift assets while retaining some control over how they are used. With careful planning, trusts can help reduce IHT liabilities. A wealth planner can guide you through this complex but effective strategy.

4. Pensions

Pensions remain one of the most tax-efficient vehicles for estate planning as they currently sit outside your estate for IHT purposes.

However, changes announced in the 2024 Autumn Budget may alter this benefit:

- From 6 April 2027, defined contribution and some defined benefit pensions will be assessed for IHT purposes.

- A consultation on this change is ongoing, with further details expected in 2025.

5. Business relief

Business relief offers valuable IHT savings on qualifying assets. Significant reforms to this relief were introduced in the 2024 Autumn Budget:

- Starting 6 April 2026, a single £1m allowance will apply to qualifying property at 100%.

- Qualifying property above £1m will receive 50% relief, resulting in an effective 20% tax rate.

- AIM shares will benefit from 50% relief but will no longer qualify for the £1m allowance.

A technical consultation on these changes is expected in early 2025, including their impact on trusts.

6. Protection cover

Protection policies, such as life insurance written in trust, can help cover IHT liabilities or provide liquidity for other costs. Reviewing your cash flow forecast will help you assess how much protection you might need.

- Whole of life policies: In 2023, 28,975 policies were taken out to provide funds for IHT liabilities, a 4% increase year-on-year, reflecting growing awareness of their value.

7. Family investment companies (FICs)

FICs are private limited companies designed to manage and transfer family wealth while mitigating IHT. They allow assets to grow outside the founder’s estate and enable control over wealth distribution through tailored share structures.

While effective, FICs are complex structures requiring careful legal and financial advice. A wealth planner can help ensure they are set up and managed correctly, aligning with your family’s goals.

8. Wills and powers of attorney

A professionally drafted will ensures your estate is distributed according to your wishes, while a lasting power of attorney (LPA) enables trusted individuals to manage your financial affairs if you are unable to do so.

Key takeaways

Estate planning is about enjoying your wealth today while ensuring the right people benefit when you’re gone. A tax-efficient wealth transfer strategy requires careful consideration of your financial goals and a tailored approach.

Avoid hasty decisions: While the Budget has announced significant changes, there is still time to plan. Many rules will not take effect for several years, and final legislation may evolve.

Don’t delay taking action: Start conversations with your financial planner now to ensures you can leverage these strategies before further legislative changes take effect.

How we can help

Our wealth planning team can help you create a personalised strategy that aligns with your goals. If you’d like to discuss your estate plan, contact your Arbuthnot Latham relationship manager, or learn more about becoming a client.

Our wealth protection services - for you and your family

With the right level of protection, you and your family can remain financially secure should unexpected events happen.

Working with our Wealth Planning team, we can help you to find the right solutions to meet your needs, drawing on solutions from across the market.

Guide to personal protection

An introduction to the importance of protecting your wealth through various life stages and circumstances.

Find out how you can ensure the financial security for you and your family.

Brochures & email subscriptions

Request a brochure, or subscribe to our email updates.

Author -

Gary Jasper

Senior Wealth Planner

Gary is an experienced wealth manager with over 25 years of success advising high-net-worth clients on investment and inheritance tax planning. Known for building strong, lasting relationships, he specialises in providing tailored financial advice to meet individual client needs.

DISCLAIMER

This communication should be considered a marketing communication. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research. It is for information purposes only and does not constitute advice, a solicitation, recommendation or an offer to buy or sell any security or other investment or banking product or service. You should seek professional advice before making any investment decision. The value of investments, and the income from them can fall as well as rise, and may be affected by exchange rate fluctuations. Investors could get back less than they invest. Past performance is not a reliable indicator of future results. The tax treatment of investments depends upon individual circumstances and may be subject to change.

The contents of this communication are based on opinions or conditions as at the date of writing and may change without notice. To the extent permitted by law or regulation, no warranty of accuracy or completeness of this information is given and no liability is accepted for its use or reliance on it.