Today

From Merchant bank to Private Bank

The Arbuthnot Latham story is a colourful one. 188 years after our formation, we are one of few merchant banks whose name continues to deliver a secure, high-quality and personal service. Starting as merchants, the company soon branched out into finance and lending. Today, Arbuthnot Latham offer Private and Commercial banking as well as Wealth Planning and Investment Management services for our clients.

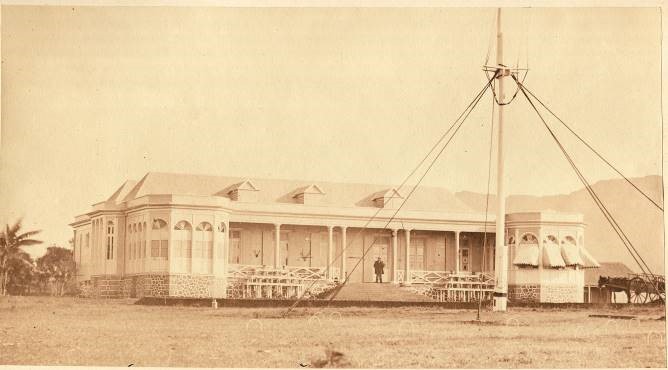

1833

Arbuthnot & Latham opens for business

John Alves Arbuthnot and Alfred Latham opened their first premises in 33 Great St Helen’s on 13 May 1833. In 1858 John Alves Arbuthnot became Governor of the London Assurance and in 1861 Alfred Latham became Governor of the Bank of England.

1900

Arbuthnot & Latham continues to thrive

Between 1833 and 1900, the company prospered as a merchant of produce from India, such as cotton, tea and jute. By the end of the century, the company’s financial services were proving to be more significant than its trading activities.

1914

Founding members of the Accepting Houses Committee

The accepting houses (Arbuthnot Latham being one) were struggling in the economic uncertainty surrounding the first world war. Arbuthnot Latham became one of the founding members of the Accepting Houses Committee, a body set up to collectively press their banking interests with the government and Bank of England.

1933

Arbuthnot Latham & Co. marks 100 years

The bank celebrates a century in business with a centenary dinner. Marking the 100 year Arbuthnot Jubilee. With guests in attendance ranging from long-standing clients, local business leaders and politicians.

1941-1959

Bank head office destroyed in The Blitz

Only a few staff were retained at Arbuthnot Latham’s St Helen’s Place office during The Blitz. The rest relocated to Hertfordshire. The City offices were hit by German bombs on the night of 16-17 April 1941 and eventually succumbed to fire ten days later.

1981

Dow Scandia acquires the bank

Citing the difficulty of competing in an increasingly international marketplace, the Arbuthnot family link to the bank which had lasted for almost 150 years was broken. They sold the bank to Dow Scandia and Sir Henry Angest became CEO in 1982.

1994

The Arbuthnot Latham brand is revived

Arbuthnot Latham changed hands a couple of times after Dow Bank sold it. Having successfully taken control of Secure Homes (latterly Secure Trust) - a separate bank - Sir Henry Angest set his sights once again on Arbuthnot Latham, initially securing Arbuthnot Fund Managers and crucially, the Arbuthnot Latham name.

2012

Arbuthnot Latham acquires Wilson Street freehold

The freehold of Wilson Street is acquired as the intended new headquarters of Arbuthnot Banking Group. The building, which is split over six floors, is home to our front line and support teams. As well as a range of client meeting rooms and event spaces.

2013

Arbuthnot Latham begins a journey of growth

Having celebrated its 180th Anniversary in 2013 and an office already open in Exeter, Arbuthnot Latham also opens regional offices in Manchester, and Bristol. The bank also forms a commercial banking arm and acquires Renaissance Asset Finance, as well as launching Arbuthnot Asset Based Lending Ltd.

2023

Arbuthnot Latham celebrates its 190th anniversary

On the back of a robust trading position and future growth prospects, the private and commercial bank secures new long-term premises at 20 Finsbury Circus.